Despite severe cold weather advisories across the GTA, one thing that remained hot this winter was Toronto’s real estate market. With the drastic increase of property sales and fewer active MLS listings, the hunt for a new home is still a tough one for countless prospective owners.

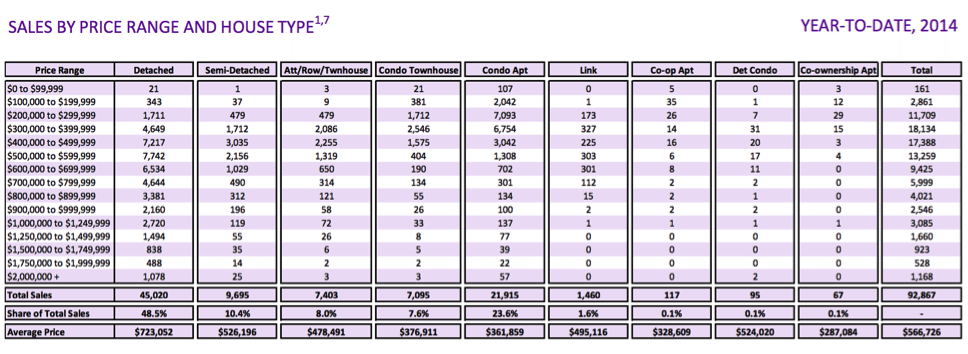

Toronto experienced a near record year in 2014 with 92,867 residential sales reported through the Toronto MLS system. This was a 6.7 per cent increase over real estate sales in 2013, just shy of the 2007 record. The substantial price increase can be attributed favourable mortgage rates, resulting in a shortage of available homes for sale and steep competition between buyers. Newton’s famous expression “What goes up must come down” can certainly be applied to our housing market, however, how soft or hard of a landing will it be?

According to many economists, the Canadian economy will face a turning point in 2015 —interest rates are predicted to rise causing prices of homes to decrease and the market to level out. When will this prediction come into fruition? Expert opinions vary between a stormy economic outlook for due to sliding oil prices, to a Hail-Mary recovery with increased employment across all sectors, in addition to demand for Canadian exports from south of the border.

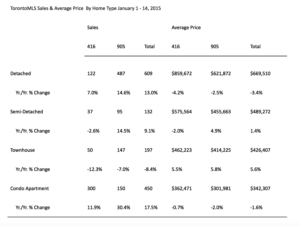

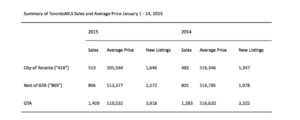

With only a month into the New Year, the GTA housing sector is still riding the strong wave of 2014. Toronto Area REALTORS® reported 1,409 sales through the Toronto MLS system during the first two weeks of January 2015. This is a 9.8 per cent increase compared to the same time last year. Hopeful homebuyers are still scrambling to take advantage of low mortgage rates, however, the number of houses for sale will remain on the low-end until prime rate goes up around mid-year.

[bs_row class=”row”]

[bs_col class=”col-xs-6″]

[/bs_col]

[bs_col class=”col-xs-6″]

[/bs_col]

[/bs_row]

If you aren’t a commercial real estate investor and are interested in purchasing a home this year, relying on one source of information isn’t advisable and as always, prepare for the worst. The Canadian housing market is known to be temperamental and while many anxiously wait for prices to drop, affordability might not come easily with staggering mortgage rates, which will increase in the near future.

Source: Toronto Real Estate Board, CREA, RBC Economic Research

Top economic stories to look out for this year:

Hamilton’s strong housing market, energy companies scaling back on investment, Canadian stock market plunging, low Canadian dollar coupled with drop in Oil prices leaving consumers with additional disposable income for local spending.